This has very serious compliance and tax issues. As an instance suppose your Company owes Amount Due From Directors based on the outstanding amount and Bank Negara Malaysia BNM average lending rate.

Balance Sheet Central Africa Tax Guide

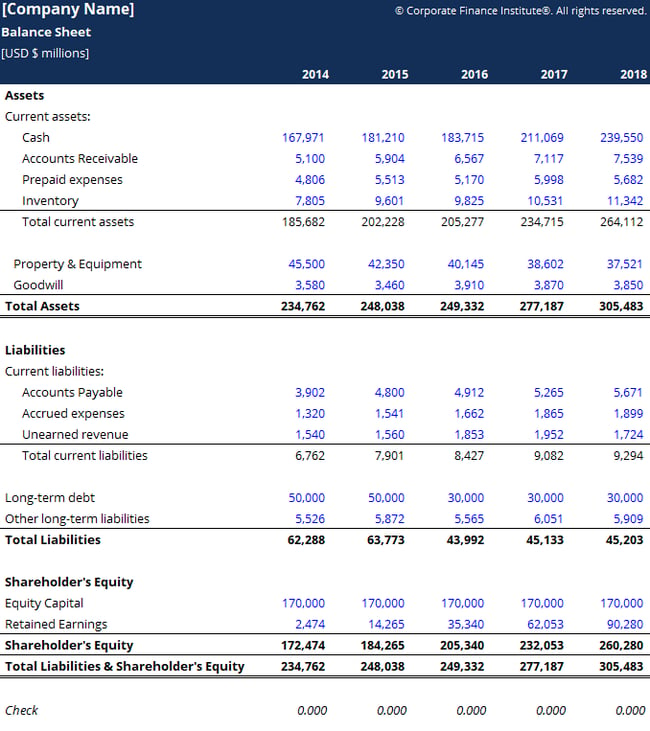

On Company ABCs Balance Sheet the Total Assets are 100000 while the Total Liabilities are 40000.

. AMOUNT OWING TO DIRECTORS The amount due to directors are unsecured interest-free and have no fixed term of repayment. On 01 April the remuneration committee decide to pay the 10000 to each director. When you set up the business you may have input a capital payment from your own funds.

Example of Directors Loan Account 42 Example 2 Eddie puts money into his Limited Company of 10000 to cover the costs of setting up his business. Company ABC has 3 executive directors and 2 non-executive directors. If the loan is to be paid back in less than one year the receivable should be part of current assets on the balance sheet.

The main worry is that if the company becomes insolvent the Director will be required by the liquidator to repay the amount owing to the company - ie 24000 in the above example. This way it will be one of the options on the drop down menu under Payment Account. Payments may be due every 5 th of each month beginning in 3 months from the date of issue.

A separate note receivable account should be created and named Due from Shareholder to separate this type of receivable from other receivables from the ordinary course of business. Companies are liable under section 455 of the Corporation Tax Act 2010 to pay a 325 tax charge on loans to directors and certain other individuals that are not repaid on a permanent basis within nine months of the end of the companys accounting period. Their amounts appear on the companys balance sheet if they.

The DLA is a combination of cash in money owed to and cash out money owed from the director. It sounds as if the company gave a loan to the directors. Liabilities are a companys obligations amounts owed.

The 202021 version is available now. If Company ABC had Total Liabilities of 50000 with its Total Assets. This seems madness to me.

In the books of Unreal Corp. Of course this is more important if the amount is a due from shareholder. Payable immediately or on demand.

The DL is paid back within 9 months after financial year end. For the monthly payments multiply the total debt with the interest rate and divide the answer by 12However you can also convert per annum interest rate into per month rate as done in the above example. The charge used to be 25 but it went up when the the dividend tax rates went up.

I am filing my company accounts LTD Micor Entity. This year my company has accumulated enough retained earnings and I am considering having it pay me back. The quotient of current value and amount owed.

Are you sure its not amount due to. The director may loan the company 1000 to pay a supplier or cover working capital requirements he may also pay for several items of stationery and postage on behalf of the company using his own cash. If you create this account under Account type of Current Liability you would only be able to post the amendments as General Journal.

Surely the directors loan would have to be treated as a creditor and the other side of. June 26 2021 1141 AM. Ad For Less Than 2 A Day Save An Average Of 30 Hours Per Month Using QuickBooks Online.

Recording Shareholder Loan Payback. A due from account is an asset account in the general ledger used to track money owed to a company that is currently being held at another firm. Tig OP Deal Addict Mar 8.

I tracked this loan as a Due to Shareholder liability on my balance sheet. Eddie is owed 2500 from his Limited Company and his directors loan account will appear as a creditor in the balance sheet. DEFERRED TAXATION The annexed notes form an integral part of these financial statements.

If you would like to re. However I do not know how to do the right reporting when filing for the. On 20 April the company has made a payment of 50000 to all directors.

Payment of 100000 over 12 months paid from the bank. However due to the payment process and cash flow issue the payment is delayed. The trial balance rolls up the information from the general ledger which includes all the financial accounts of a business.

The two columns show the due to and due from accounts. If you take cash out of the business then your directors loan account is overdrawn you owe the company and the asset is shown in the balance sheet until you repay it. Show accounting and journal entry for directors remuneration at the end of the year if the payment is done via cheque.

A balance sheet account that defines a transaction between a director of a company and the business. Principal payment Total payment per month Oustanding loan balance X Interest rate per month. The board of directors for Unreal corp.

For the calculation of principal payment the following formula is used. Since equity is equal to this difference the equity of Company ABC at that time is 60000. It forms part of your companys accounting system and is required because a limited company is a separate legal entity to its ownersdirectors.

Find the annual simple interest rate r. I have one issue about the Dirctor Loan. In laymans terms if your Company has Amount Due From Directors you have to calculate an interest income for the Company based on the outstanding amount and Average Lending Rate ALR by Bank.

To my surprise the other accountant had recognised a 15k directors loan as a type of equity in this companies balance sheet. Future value of an annuity due definition. A Directors Loan Account records money that you pay into your company and funds that are withdrawn.

The loan from the company will show as a balance owed to the company from the director. Free Trial - Track Sales Expenses Manage Inventory Prepare Taxes More. In this case the difference between the assets and liabilities is 60000.

The ledger is divided into two columns. Are owed as the result of a past transaction Are owed as of the balance sheet date Include money received before it has been earned Liabilities and stockholders equity are generally referred to as claims to a corporations assets. What Is Amount Due To A Director.

Jan 13th 2016 1008 am 15. I took a loan of 4k from my LTD Company as Director and paid back within 9 Months so no Tax implications. If you want to use the Due to Shareholder account on the expense form set it up in the Chart of Accounts as a Credit Card.

Approved a payment package of 100000 per month including the bonus for one of its directors. Payments may be due every 5 th of each month beginning in 3 months from the date of issue. Liability accounts are accounts that show the amount of money that is owed by the business.

Say you take 10000 out of the company on 31-January.

Understanding Company Accounts Corporate Watch

Balance Sheet Example The Law Student Blog

How To Calculate Total Assets Definition Examples

How To Put Balances To Manager S Profit Loss Account Items Manager Forum

Insights European Gateway Eg Newsroom

Insights European Gateway Eg Newsroom

What Is The Current Portion Of Long Term Debt Bdc Ca

Financial Statements 101 How To Read And Use Your Balance Sheet

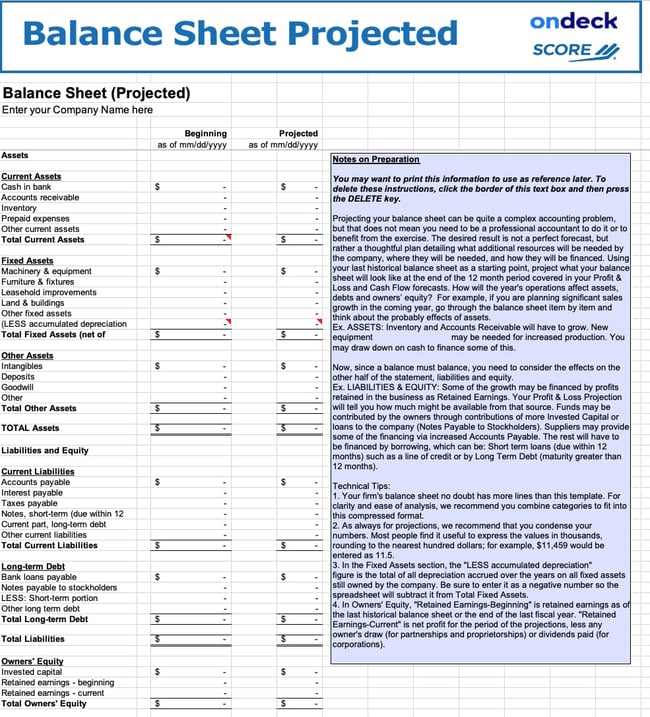

Projected Balance Sheet Bowraven Limited Small Business Software Solutions

Understanding Company Accounts Corporate Watch

/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

Financial Statements Definition

3 Amount Owing To Directors The Amount Due To Directors Are Unsecured Interest Course Hero

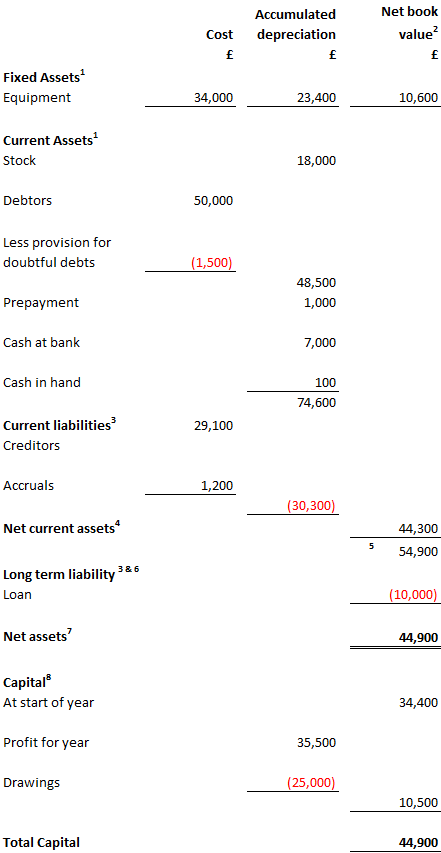

The Balance Sheet Accounting 4 Business Studies Students

Balance Sheet Ratios Types Formula Example Accountinguide

Balance Sheet Explained Maslins Accountants Maslins Accountants

:max_bytes(150000):strip_icc()/ScreenShot2021-08-21at5.02.29PM-f5d77e3185ff4122a026ba2a6c89c6de.png)